18

December

2014

HYDROCARBON

ENGINEERING

misalignment or simple lack of the tools and processes required

to make the right decisions. Despite the difficulties, it is possible

to set up the right operating model by putting in place

appropriate systems, processes, incentives and value adjusting

mechanisms. It is a hard task, no doubt, but one that would

significantly contribute to value creation when developing a new

megasite.

Project execution

The capital investment in planned megaprojects in ASEAN

countries totals more than US$ 50 billion up until 2020. This is a

significant capital outlay that needs to be well managed. The size,

scale, complexity and technological requirements of these

megaprojects place significant demands on the project

management and execution capabilities. NOCs need to develop

these capabilities. This requires having in place a rigorous stage

gate and governance model for the overall megaproject with

appropriate checks and balances across the stage gates. Checks

and balance processes typically comprise of ‘value engineering’

and ‘value assurance review’ type processes that the NOC should

periodically conduct to ensure that the projects economics still

hold. NOCs also need to develop the right contracting strategy,

risk management approach and project management capabilities

to work effectively with the multiple PMC and EPC contractors.

Manufacturing excellence

Developing the right operational and commercial capabilities to

run the megasites is critical to ensure the long term

competitiveness of the site. Developing the manufacturing/

operations organisation (structure, people, capabilities) needs to

start very early on and well before the start up of actual

operations. This will ensure the operators are well trained by the

project execution teams/EPC contractors and develop an

understanding of the assets being set up. Too often, NOCs/

project developers are singularly focused on the execution of the

project and leave it very late to think about key operational

readiness aspects. This can cause significant issues such as

delayed start up, slow ramp up and significant unplanned

downtime in the early stages of the operations. Even with the

best project execution, the loss of the early cash flows can

significantly impact the overall project economics. Hence,

starting early and developing the right operations and

commercial strategy as well as organisation is critical.

Workforce development and skills

upgrading

Finally, NOCs would need to consider a differentiated approach

to developing the required capabilities in house not only in

projects and operations but also in the area of marketing, trading

and distribution. But this by itself is insufficient and would not

lead to a best in class megasite. NOCs would need to go beyond

developing their own in house capabilities and incubate the

development of technical, vocational and administrative

capabilities on the site to ensure that outside investors are

attracted by the higher quality of the workforce. Workforce

development could be done through dedicated training

academies or vocational centres on the site through partnerships

with specialised companies. A high quality workforce is a

distinctive competitive advantage for the long term sustainability

of the site.

Conclusion

In summary, ASEAN countries are embarking on a

US$ 50 billion investment campaign in megasites during a time

where the global petrochemicals competitive landscape is

evolving rapidly and ASEAN region as a whole is becoming

increasingly oversupplied in key products. Developing the

megasites in a cost competitive manner is not just a ‘nice to have’

but a survival imperative for the NOCs and their joint venture

partners to ensure the long term sustainability of their multi

billion dollar investments. Failure to take a rigorous and holistic

view on optimally developing the megasites will only lead to

disappointing investment returns and a missed opportunity to

play a key role in the increasingly important ASEAN chemicals

market.

References

1. Consisting of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar,

Philippines, Singapore, Thailand, Vietnam.

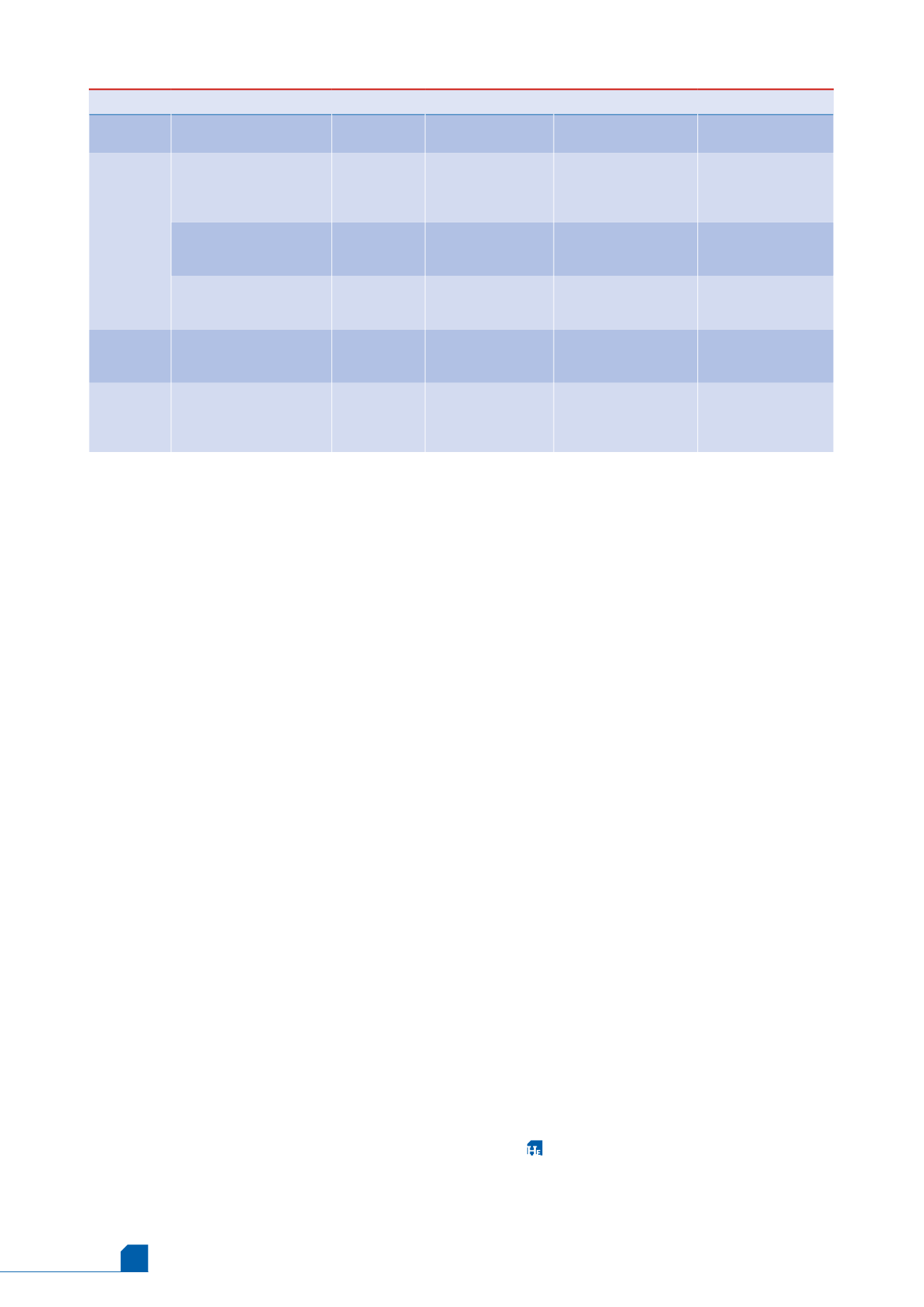

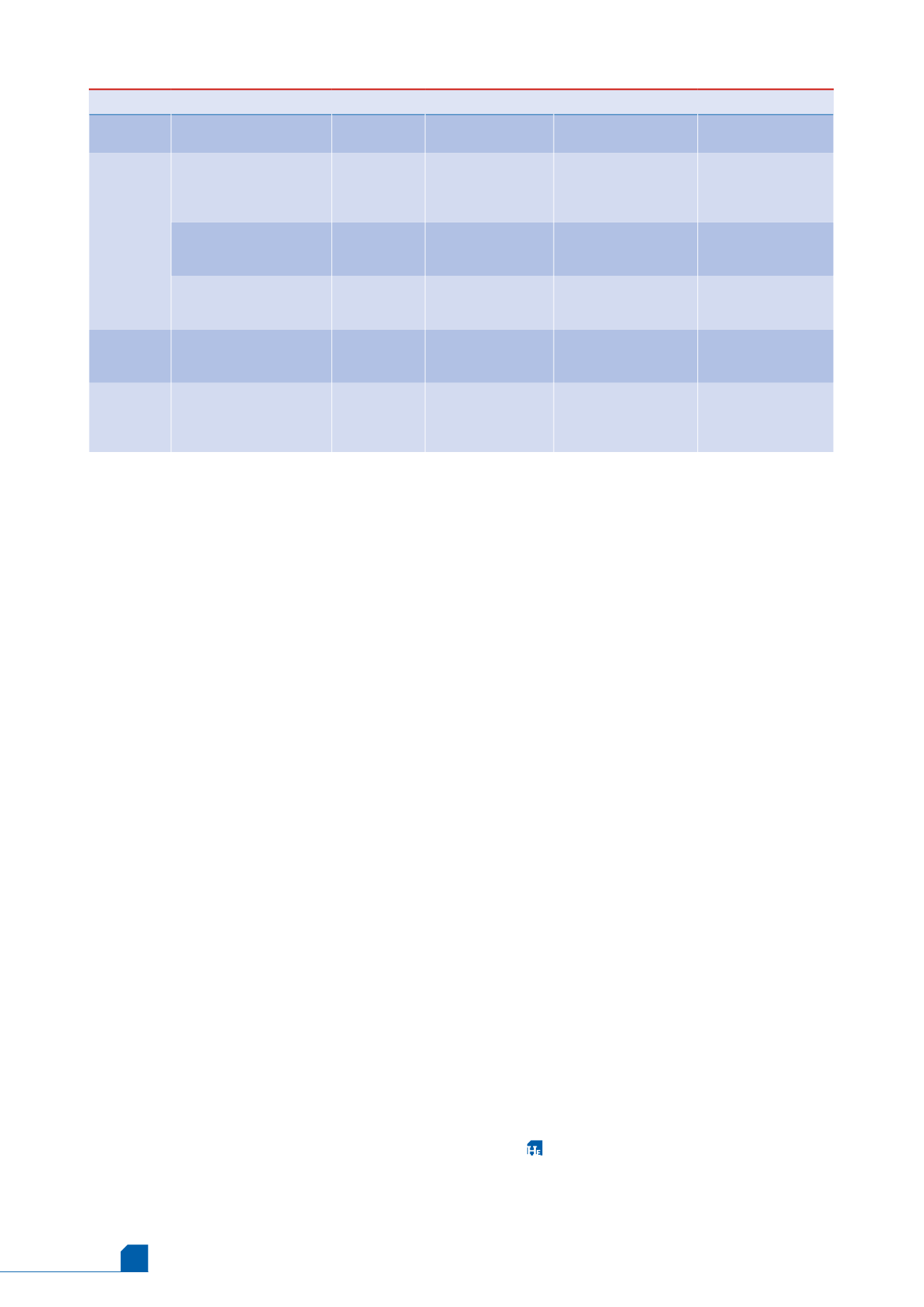

Table 1.

List of key megasites being considered in ASEAN countries and international partners

Country

Project name/location

Status

Planned investment

(billion US$)

Project owners and

international partners

Project description

Vietnam Nghi Son refinery and

petrochemical project

FID

8.0

PVN

Mitsui Chemicals,

Idemitsu, Kuwait

Petroleum International

Integrated refinery

and petrochemicals

complex

Nhon Hoi

Petrochemical complex

project

Planning

20.0

PTTGC

Petrovietnam and other

JV Partners

Integrated refinery

and petrochemicals

complex

Indonesia

Integrated petrochemical

complex, Balongan

Planning

5.0

Indo Thai Trading (JV

between Pertamina and

PTT GC)

1.2 million tpy of PE

and PP; 1 million tpy of

MEG and butadiene

Brunei

Integrated and refinery and

aromatics cracker plant

Planning

4.0

Hengyi Industries,

Hongkong Tianyi,

Damai Holdings

1.5 million tpy of PX

in addition to refined

fuel products

Malaysia

Pengerang integrated

complex

FID

16.0

Petronas,

Evonik Industries,

Versalis,

Itochu Corporation

Refinery &

petrochemicals

integrated

development (RAPID)