14

December

2014

HYDROCARBON

ENGINEERING

recently took the final investment decision (FID) to proceed with a

refinery and petrochemical integrated development project

(RAPID). Indonesia is also moving forward to revamp its existing

refineries and add petrochemicals complexes. Together, the

cumulative investments in the ASEAN petrochemicals

megaprojects are expected to total more than US$ 50 billion by

2020.

The national oil companies (NOCs) in the ASEAN region are

often the main project developers of these megasites. The primary

drivers for developing these sites are to achieve greater self

sufficiency for petroleum fuel products and the basic

petrochemicals/polymers, create an export hub, create local

employment opportunities and develop the local workforce.

These NOCs will need to address a number of critical questions to

ensure the long term attractiveness and stability of returns on

these megasites in a context of increasing competitive pressure

fromMiddle East and North American regions.

An increasingly over supplied

ASEAN market

Petrochemicals demand in ASEAN countries has been growing

rapidly over the last decade and is expected to continue at a

similar pace over the next decade driven by strong

macroeconomic fundamentals, a growing middle class and

increasing urbanisation in the region. Average GDP growth for the

ASEAN bloc of countries has been averaging approximately 5%

since 2007 and the GDP is expected to increase by approximately

1.5 times by 2020. In addition, approximately 96 million people are

expected to have joined the middle class between 2010 and 2015

and the number is expected to grow further in the coming years.

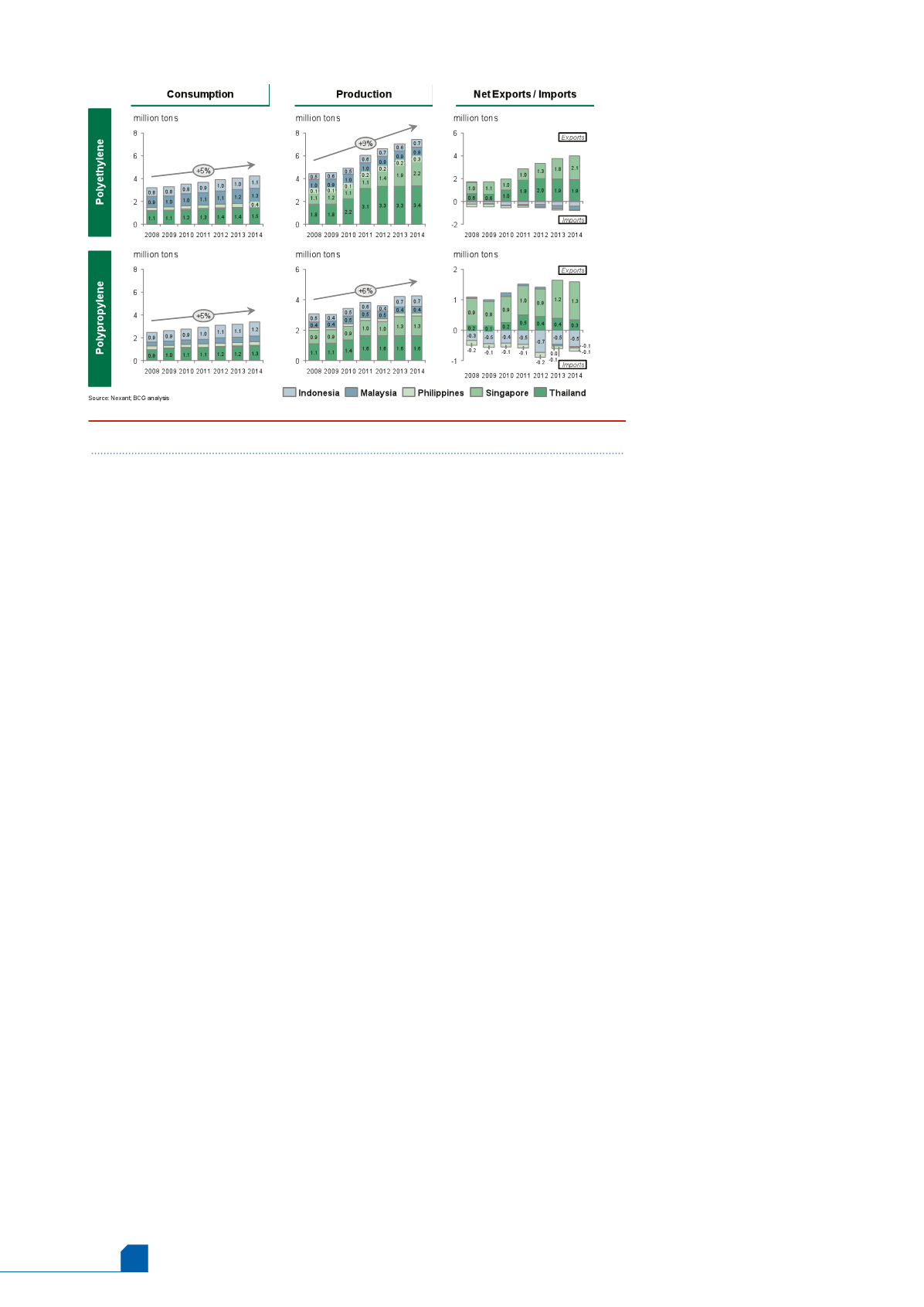

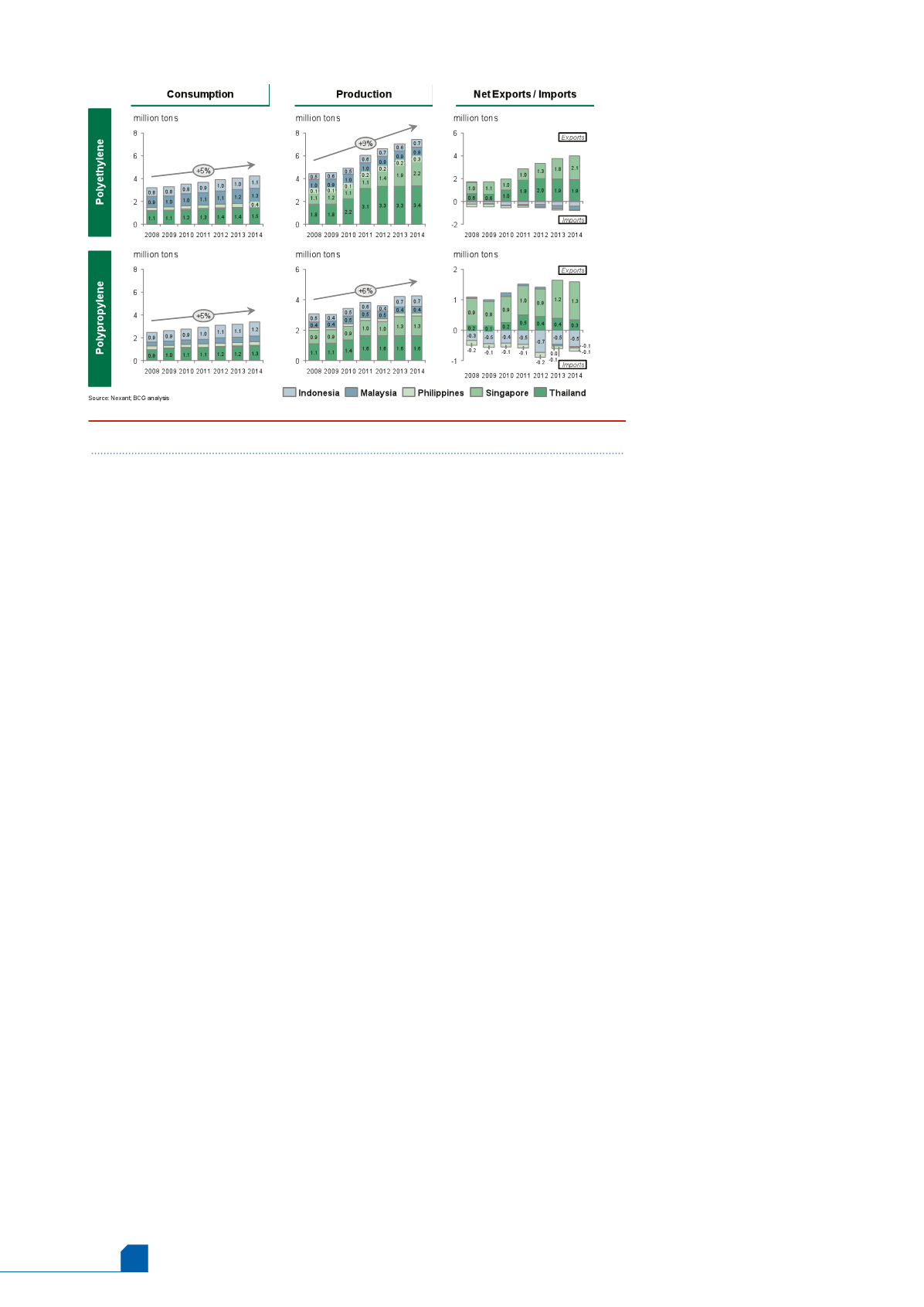

As such, demand for basic petrochemicals has been growing

rapidly across most of the countries. For example,

polypropylene (PP) and polyethylene (PE) demand have been

growing at approximately 4.5 - 6.1% between 2008 and 2014 across

the key consuming nations of Indonesia, Thailand, Malaysia and

Vietnam. However, supply has also been increasing rapidly

especially in Singapore, Thailand and Philippines which have seen

more than double digit growth in PE and PP production between

2008 and 2014. As such, the ASEAN countries currently face a

structural oversupply within the region with increasing supply/

demand imbalances between

countries where Indonesia,

Malaysia and Vietnam have seen

growing imports while Singapore

and Thailand continue to be major

exporters of PE and PP (Figure 1).

The same is also true for the

aromatics products such as

benzene and styrene.

‘Middle of

the pack’ cost

positioning

Asian petrochemical producers and

ASEAN players in particular have

traditionally had a low share of

cost competitive ethane based

steam crackers. Regions such as the

Middle East have traditionally

enjoyed the lion’s share of ethane

(or ethane/propane) crackers due to the availability of cheap gas

feedstock but with the shortage of gas in the region, new

megaprojects in the Middle East are moving to more mixed

feedstock. Nonetheless, by 2018 the Middle East region will still

have approximately 74% of its 33 million t cracker capacity run on

either ethane or ethane/propane steam crackers. With the rise of

the shale gas revolution in North America and setting up of new

projects based on the availability of cheap gas, North America is

expected to have almost 50% of its 43 million t cracker capacity

based on ethane or ethane/propane steam crackers by 2018. By

contrast, that number is only 9% in Asia with its projected

70 million t cracker capacity with a further 7% of capacity run on

coal based olefins plants mainly driven in China. In contrast to

these three regions, Europe only has 3% of its 24 million t cracker

capacity run on ethane/propane feedstock.

Given this competitive landscape, the ASEAN producers are

currently disadvantaged compared to North American, Middle

Eastern and other Asian producers (Figure 2). Seen as part of the

ethylene cost curve, the ethylene margin of ASEAN producers

is expected to reduce from approximately US$ 110/t to

US$ 10 – 50/t by 2020 as the new projects planned in Asia come

online. This decrease in margins comes despite the fact that

ASEAN producers are closer in proximity to the demand centres in

north east Asia and have lower product logistics costs compared

to other regions.

The dynamically evolving competitive landscape places

significant challenges on the long term competitiveness of the

megasites currently being set up in ASEAN countries. The key

question confronting the ASEAN producers is their viability as a

export hub and whether their feedstock disadvantage can be over

compensated by the world class logistics and geostrategic

positioning and proximity to north east Asia.

Maximising value from ASEAN

megaproject investments

ASEAN producers are currently setting their megasites through

significant brown field expansions of existing sites or green field

investments in new locations. For example, Vietnam has made the

FID to build one refinery and is planning another integrated

refinery and petrochemicals project. These projects in Vietnam

Figure 1.

Supply/demand balance of PE and PP across key ASEAN countries.