16

December

2014

HYDROCARBON

ENGINEERING

have a projected capital investment budget of US$ 28 billion. In

addition, neighbouring Malaysia, Indonesia and Brunei are also

planning their own independent refinery and petrochemicals

complex to fulfill similar needs.

Taken together, these integrated refinery and petrochemical

sites represent more than US$ 50 billion investments over the next

few years till 2020 (Table 1). In addition to these megasites, a

number of individual chemicals projects are being planned or

developed across the region. This is a massive investment plan in

the coming years and needs to be very well thought through by

the project sponsors and developers in terms of risks and returns.

The ASEAN NOCs championing the megasites need to

address six critical areas to ensure that their investments stay

attractive and are sustainable over the long term.

Downstream investments

NOCs need to consider how far downstream they will go in each

value chain (bulk petrochemicals, polymers, engineered plastics,

specialty chemicals, etc.) to maximise the investment returns.

Since ASEAN countries are currently oversupplied as a region in

the production of bulk petrochemicals and polymers, NOCs need

to look into the growing demand for other chemical products

such as olefin derivatives, engineered plastics, specialty chemicals

and other niche products/green chemicals to develop the

appropriate slate of products for their integrated complexes. This

requires a detailed understanding of the end consumer markets

and customer preferences/needs and translating that into

product specifications that could be manufactured locally. It is

also essential to build significant research and development and

innovation capabilities in the NOCs as well as codevelop

application centres with customers to create new products. Only

by marrying the complex molecular chemistry with deep customer

insights and innovation capabilities will NOCs be able to develop

the right slate of products.

Site development

Once the NOCs have acquired a deep understanding of the

individual products they would produce and the individual

product requirements, they need to build up their sites in a

manner that maximises the site’s competitive advantage. Optimal

development of the site requires fundamental thinking regarding

site infrastructure (land, utilities, ports) and logistics (inbound and

outbound), access to raw materials, the

localisation of critical technologies, ways to

attract small and medium sized enterprises to

the location, incubating and developing value

added/ancillary/support services to the

businesses and attracting the right capabilities to

the site. These issues need to be fundamentally

addressed upfront and the NOCs/project

owners need to develop the right strategies to

build a truly competitive site. Megaproject

developers in ASEAN countries have the luxury

of starting from a clean sheet as a lot of the

investments are greenfield in nature. As such,

NOCs should learn from the experiences of

other integrated megasites such as the Jurong

Island in Singapore, Ludwigschafen in Germany,

Jubail/Yanbu in Saudi Arabia and ensure they

understand the current best practices in place

and how to improve upon them even further. In the experience of

the Boston Consulting Group, optimal site development is one of

the critical successes factors for a cost competitive positioning on

the petrochemicals supply curve.

Partnerships

NOCs and their joint venture partners cannot expect to do it all

by themselves when it comes to optimally developing the

megasites and housing all the right capabilities. Crafting the right

partnerships is critical to ensure optimal site development. For

example, Petronas is teaming up with consortia of international

companies such as Evonik (specialty chemicals), Versalis

(elastomers) and Itochu (downstream plants) for the development

of the RAPID project. In Vietnam, Petrovietnam is partnering with

the regional champion PTTGC to develop an integrated refinery

and petrochemicals complex with the possibility for other

international players to join in. The quality of the partnership

‘eco-system’ is extremely critical for the successful development

of the sites as partners need to bring complementary skills and

capabilities to the table.

In this context, NOCs should form a holistic view on all the

companies they could potentially partner with across key areas

such as development of utilities (e.g. cogeneration), development

of services (e.g. asset management, value added services,

maintenance/turnaround/IT services), development of logistics

facilities (e.g. warehousing, port services etc.) and development of

local workforce/ human capital (e.g. technical academies, local

research and development centers etc.). Crafting such partnerships

across all these areas requires a holistic approach, way beyond

laying out an outsourcing strategy for the various infrastructure/

service requirements.

NOCs also need to clearly identify and agree the appropriate

roles and responsibilities for the various partners involved in the

site and take upon themselves the role of the master planner and

matchmaker for the site. Developing a partnership strategy,

identifying the right partners and developing the roles and

responsibilities needs to be closely linked to the entire site

strategy. In this context, finding out the right mechanism to ensure

the whole complex is run on an integrated margin basis is

paramount to unlock the full potential and value of the megasite.

Capturing the full value of integration is difficult, even in sites that

have a single owner, given cultural differences, incentives

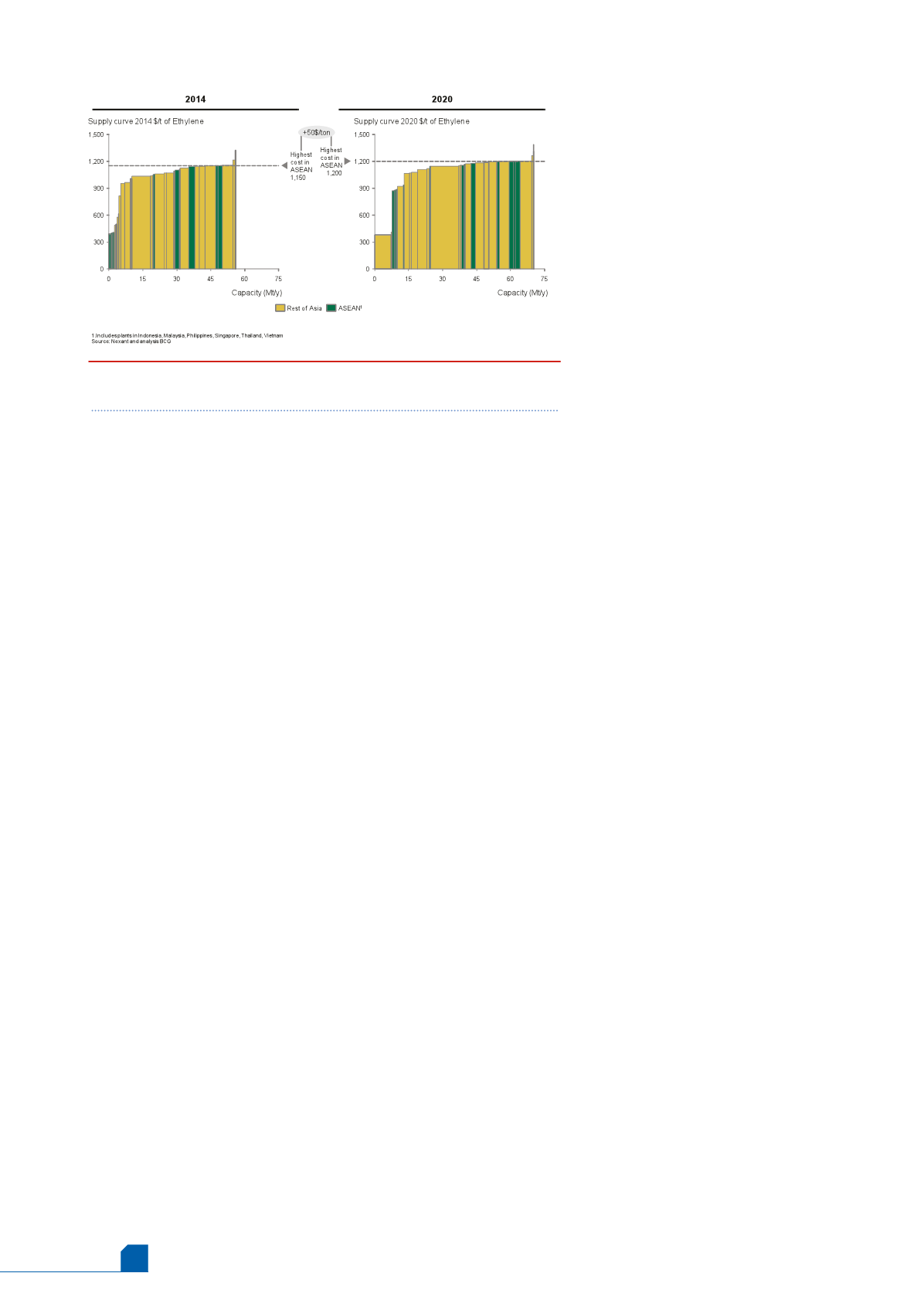

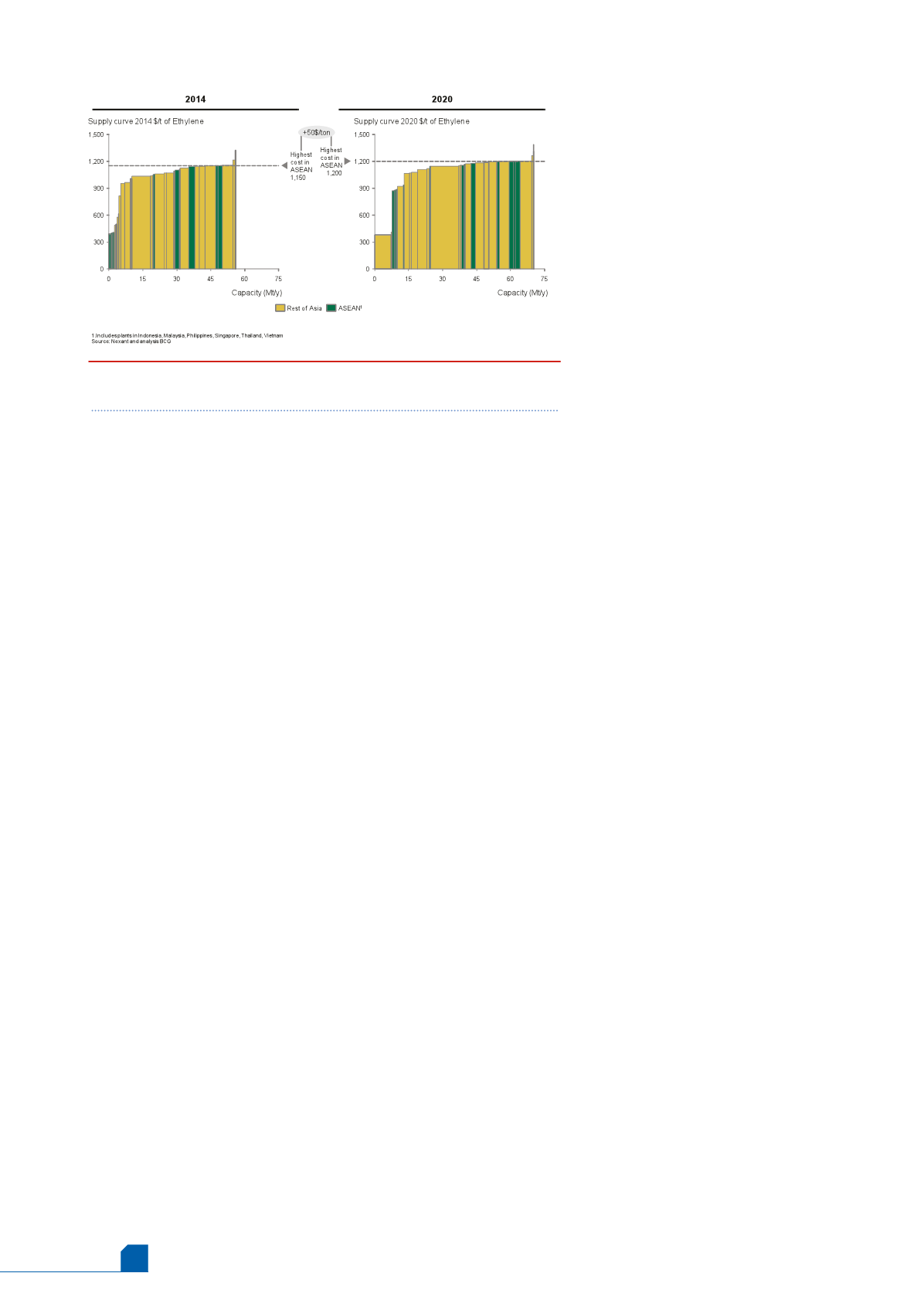

Figure 2.

ASEAN ethylene cost curve and challenging cost

positioning of ASEAN companies.