14 |

OilfieldTechnology

February

2014

isplanningtoraiseproduction levels fromthe fieldto2.85millionbpd

fromthecurrent960000bpd.Additionally, thecontractorhasbeen

awardedonePMCcontract fortheWestQurnaTwooilfield,andthree

intheUAE.AsaFEEDcontractor,WorleyParsonshasoperated in

SaudiArabiaandKuwait,securingtwosuchcontracts inbothcountries.

Saipemhas followedcloselybehind, securing10EPCcontractsand

threeFEEDcontracts,almosta thirdofwhich (4)are inSaudiArabia.

Here the Italiancontractorhasbeenawarded fourEPCcontracts,

twoofwhicharecontracts totallingUS$1.35billion foroffshore

constructionandpipelayingworkon theWasitGasDevelopment

Programme.Theprogramme ispartofSaudiAramco’splans to

augmentgassuppliesbyadding50 trillionft

3

ofnon‑associatedgas

reserves to itsportfolio throughnewdiscoveriesby2016.

Saipemhasalsobeenprolific inAbuDhabiwhere thecontractor

hasbeenawarded threeEPCcontractswortha totalestimatedvalue

ofUS$3.6billion forpipelines, thesulfur recoveryunitand theprocess

plant for theShahsourgasdevelopment.

Reflecting thedominanceofAbuDhabi in the region in termsof

projectactivity,on thecontractorside, the top tencontractors in the

regionsecureda totalof24majorcontracts in theUAE,22ofwhichare

inAbuDhabi.

TechnipandFluorhaveboth faredwell inAbuDhabi,winninga

seriesofFEEDcontracts.Techniphassecured foursuchcontracts,

includingthecontracttocarryoutFEEDworkontheNorthEastBab

Phase3,beingdeveloped inassociationwiththe1.8MillionProject.

FluorhassecuredthreeFEEDcontracts intheEmirate,with

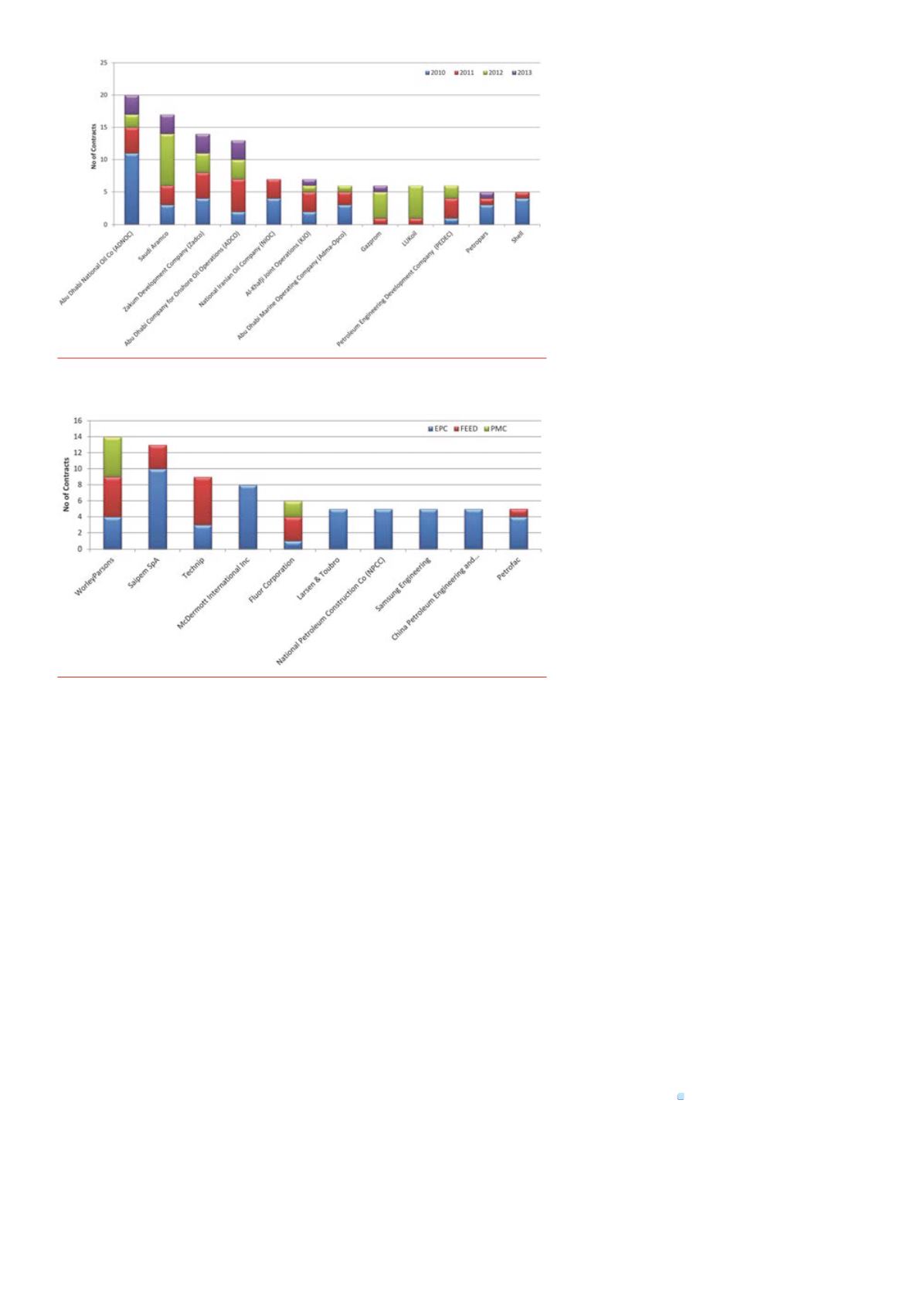

Figure3.

Top12mostactiveoperators(Jan2010‑Aug2013). Imagecourtesyof

EICDataStream.

involvement intwoofAbuDhabi’soffshoreprojects, the

SARBdevelopmentandtheNasrOffshoreoilfield.

In total,FrenchcontractorTechniphasbeen

awardeda further twoFEEDcontractsand three

EPCcontracts,with the remainingcontracts inDubai,

Egypt, IraqandSaudiArabia.

Due to thescaleofmanyprojects in the

MiddleEast,high‑valueEPCcontractsareprevalent,

and theseare frequentlyawarded toconsortiums

that togethercancombinespecialistskills to

addresscomplexworkscopes. Inaddition to its

nine individual contractawards,Techniphasbeen

awardeda further fourEPCcontracts totalling

US$3.5billion, inpartnershipwithAbu‑Dhabibased

NationalPetroleumConstructionCo (NPCC).

The largest of thesecontracts isaUS$1.7billion

EPCcontract tobuild thecentral processing facilities

for ZADCO’sUS$10billionproject to increase

production from theUpper Zakumoffshoreoilfield.

NPCC itself hasbeenawarded fiveadditional

individual contracts,worthanestimated

US$2.3billion for fabricationandpipelayingprojects

inAbuDhabi andQatar.

Contractingrelationships

In theMENA region, themost notablecontracting

relationshipshavebeenbetweenSaudi Aramcoand

contractorsSaipemandMcDermott International,

withbothcontractorsbeingawardeda total of

four EPCcontractseachby theoperator.

Inaddition to itsworkon theWasitGas

DevelopmentProgramme, Saipem’ssuccessfulbids

include further fabricationand installationwork for

offshoremodulesonboth theManifaandSafaniya,

Zuluf,Berri andMarjanoffshoreoilfieldprojects.

McDermott’smajor contractswithSaudi Aramco

arealsodominatedbyoffshore fabricationwork,withawards

forwellheadplatforms, auxiliaryplatformsandproductiondeck

moduleson theSafaniya, Zuluf,Berri,MarjanandKaran fields.

Saipemhasalso faredwellwith the region’smostprolific

operator, ADNOC, securinga total of threeEPCcontracts, all for

workon theShahsourgas fielddevelopment inAbuDhabi. Thebids

includeoneof the largest singlecontractsawarded in thisperiod, a

US$1.9billionEPCcontract for thepipelinepackage.

Aside from these twoplayers, there isabroadspreadof awards

acrosscontractorsoperating in theMENA region, from leading

Europeancontractors to thosebased in theUS, Australiaand India, as

well asanumberofdomesticcontractors.

AbuDhabi is leadingoil andgasdevelopment in theMENA region

and, althoughcontractingactivityhascooledoff thisyearelsewhere,

this is largelydue todelays rather thana lower level ofproject

activity. Significantprojects in Iraq,OmanandSaudi Arabiaare

expected tostartawardingcontractsnext year,whilenewphaseswill

come intoplayonexistingprojects.With investment levelsexpected

to remainhigh, thesemajor contractsshouldprovideabundant

opportunities for thesupplychain.

Note

For thepurposesof this report,MiddleEastandNorthAfrica

(MENA)aredefinedas: Algeria,Bahrain, Egypt, Iran, Iraq, Israel,

Jordan,Kuwait, Lebanon, Libya,Morocco,Oman,Palestine,Qatar,

Saudi Arabia, Syria, Tunisia,UAEandYemen.

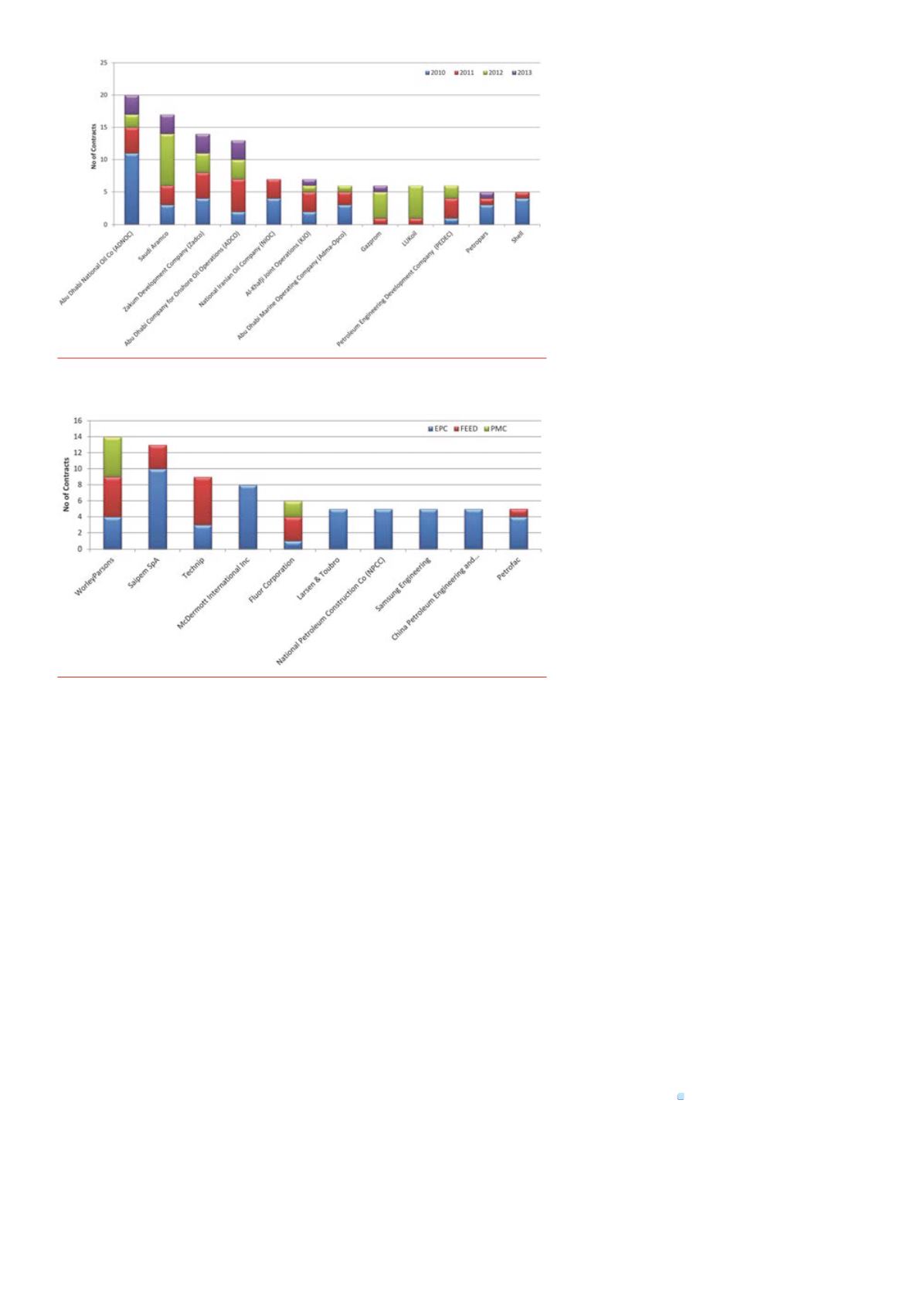

Figure4.

Top10mostactivecontractors(Jan2010‑Aug2013). Imagecourtesyof

EICDataStream.