16

LNG

INDUSTRY

SEPTEMBER

2014

LNG to buyers in Asia and also Europe. Reselling

opportunities would allow participating companies to buy

larger volumes and be able to get discounts on cargoes. This

would help drive down LNG import costs.

Establishing partnerships with other buyers

LNG importing companies from Japan have started forming

partnerships with other LNG buyers to increase their

negotiating power.

Tokyo Electric Power Co. has a proposal to tie up with

other Japanese and foreign companies to form a buyer’s

group to jointly procure up to 40 million tpy.

Government level partnerships and cooperation between

buyer countries are also expected to grow.

Investment in LNG projects overseas

Japanese LNG importers are now actively investing in

upstream gas and LNG projects worldwide to improve their

chances of securing a sustainable supply of cheaper gas.

Projects in the US and Canada are at the top of the list, as

apart from a stable investment climate, these two countries

would also be in a position to sell the cheapest LNG to Japan,

considering the depressed natural gas prices in this region.

The US could potentially supply Japan with up to

10 million tpy of LNG. LNG imports from the US are likely to

reduce the average LNG price that Japan pays to

US$ 12/million Btu by 2020.

Australia is another favoured destination for Japanese

investment in LNG projects overseas. Japanese companies

have invested in Australian projects with stakes varying from

0.5% up to 9%.

Japanese companies are also investing in LNG projects in

Southeast Asia and Africa.

Decrease purchase from spot markets

Since nuclear power is to be gradually introduced into the grid

starting in Q4 2014, extra gas to substitute for nuclear power

will be needed for a longer duration. LNG importers are likely

to reduce dependence on spot markets and try to secure

long-term contracts to obtain better rates.

Going by the demand for the base case scenario for

2017 - 2019, Japanese LNG buyers may be over-contracted,

giving scope for oversupply.

This year, Japan has started releasing spot LNG prices in a

move to improve the transparency of LNG purchases.

Futures market to delink oil and gas prices

Japan intends to establish a futures market for LNG that

would effectively delink the gas prices from oil prices. This

would shield buyers from price upswings. A futures market

would also make LNG trading global. This would reduce the

price gap between various regions.

Conclusion

The projected strong demand for LNG, increase in LNG trade,

and investments in foreign projects will create tremendous

growth opportunities for Japanese engineering, equipment

and service companies.

To meet the anticipating increase in demand, 10 more

LNG receiving stations are expected to be commissioned,

increasing Japan’s LNG receiving terminal storage capacity to

approximately 20 million m

3

by 2020 from the current level of

around 17 million m

3

.

The scale of industry growth anticipated by 2020 can be

gauged from the investment plans chalked out by the

leading Japanese LNG fleet owners Mitsui OSK Lines (MOL),

Nippon Yusen Kabushiki Kaisha (NYK Line) and Kawasaki

Kisen Kaisha Ltd (“K” Line). These companies have embarked

on a major fleet expansion drive. MOL is investing

US$ 5 billion to almost double its LNG carrier fleet strength

to 120 by 2020 from the current 66. NYK Line is planning to

raise its LNG tanker fleet to 100 by 2019 from 70, and

“K” Line has plans to add around 20 new LNG carriers to its

fleet by 2020.

Development of Japan’s renewable energy resources has

been stalled by the large monopolistic utilities. If this situation

changes, driven by the 2013 electricity reformation law, the

country could reduce its dependence on gas to a significant

extent. However, with large utilities still preferring thermal

gas plants over renewable sources, the demand for gas from

the electric sector is expected to remain high.

Globally, the LNG market is expected to tighten and be

supply constrained until the end of the decade. In this context,

Japan has done extremely well to secure its LNG supply.

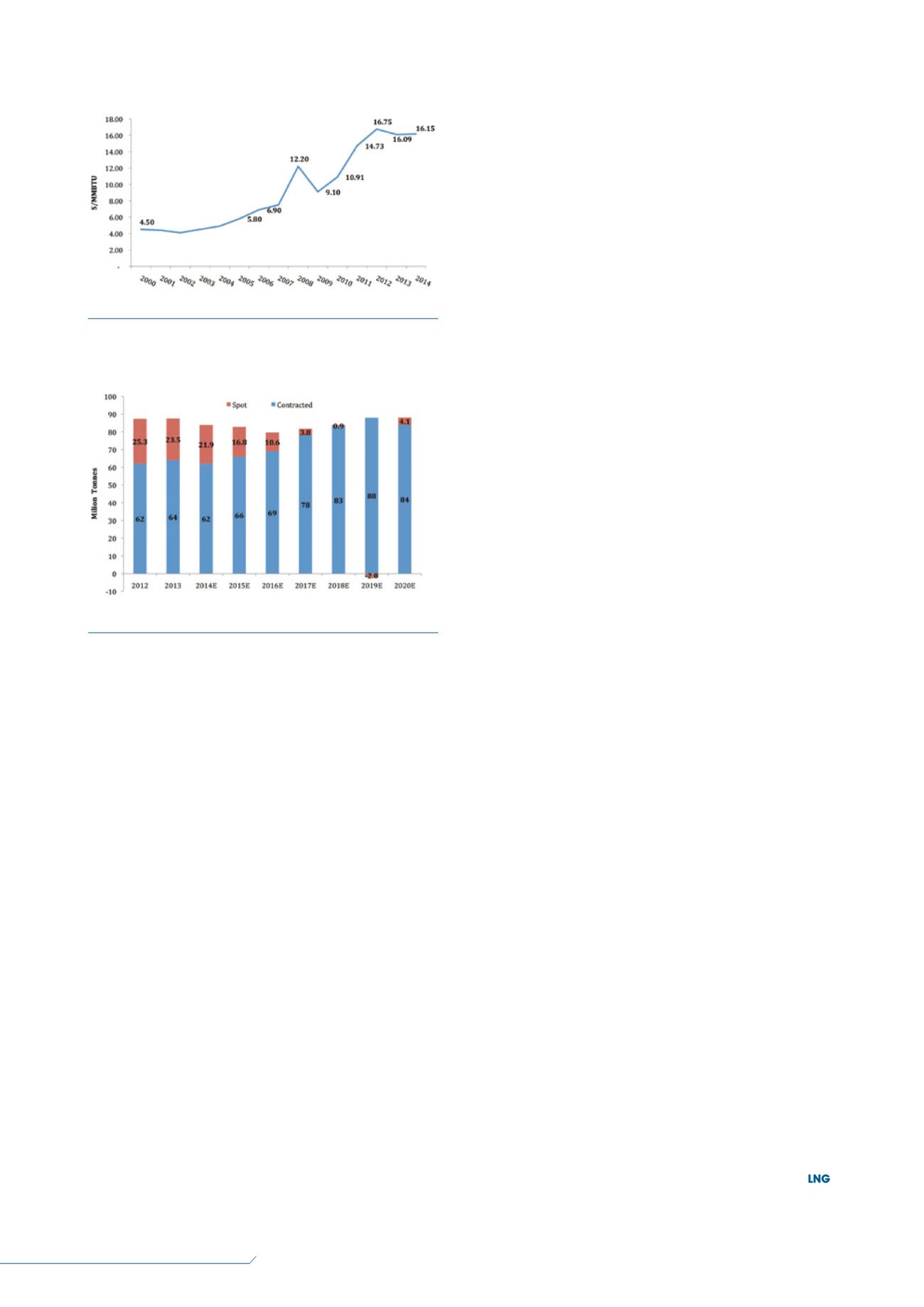

Figure 3.

Japan’s average LNG prices (data collated by Frost &

Sullivan from various industry sources).

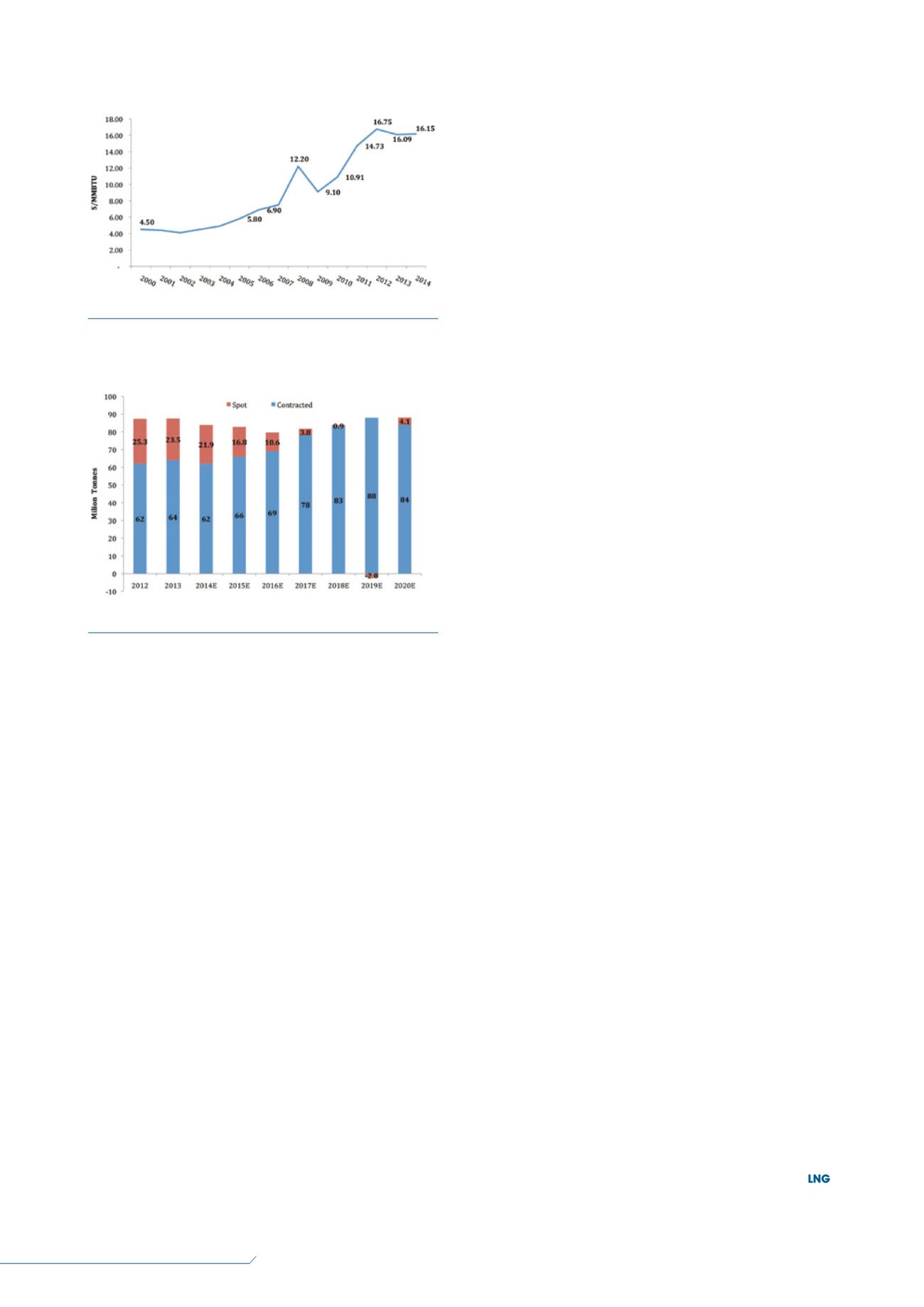

Figure 4.

Contracted and spot LNG purchases: nuclear re-entry

in Q4 2014 scenario (Frost & Sullivan forecast based on estimates

from various industry sources).