14

LNG

INDUSTRY

SEPTEMBER

2014

through service area dedicated pipelines. With a view to

avoiding duplication of facilities, a monopolistic market

situation has been created in the city gas supply areas. These

markets are regulated to take care of the interests of small

volume consumers. The market is deregulated for consumers

whose annual contracted volumes exceed 100 000 m

3

.

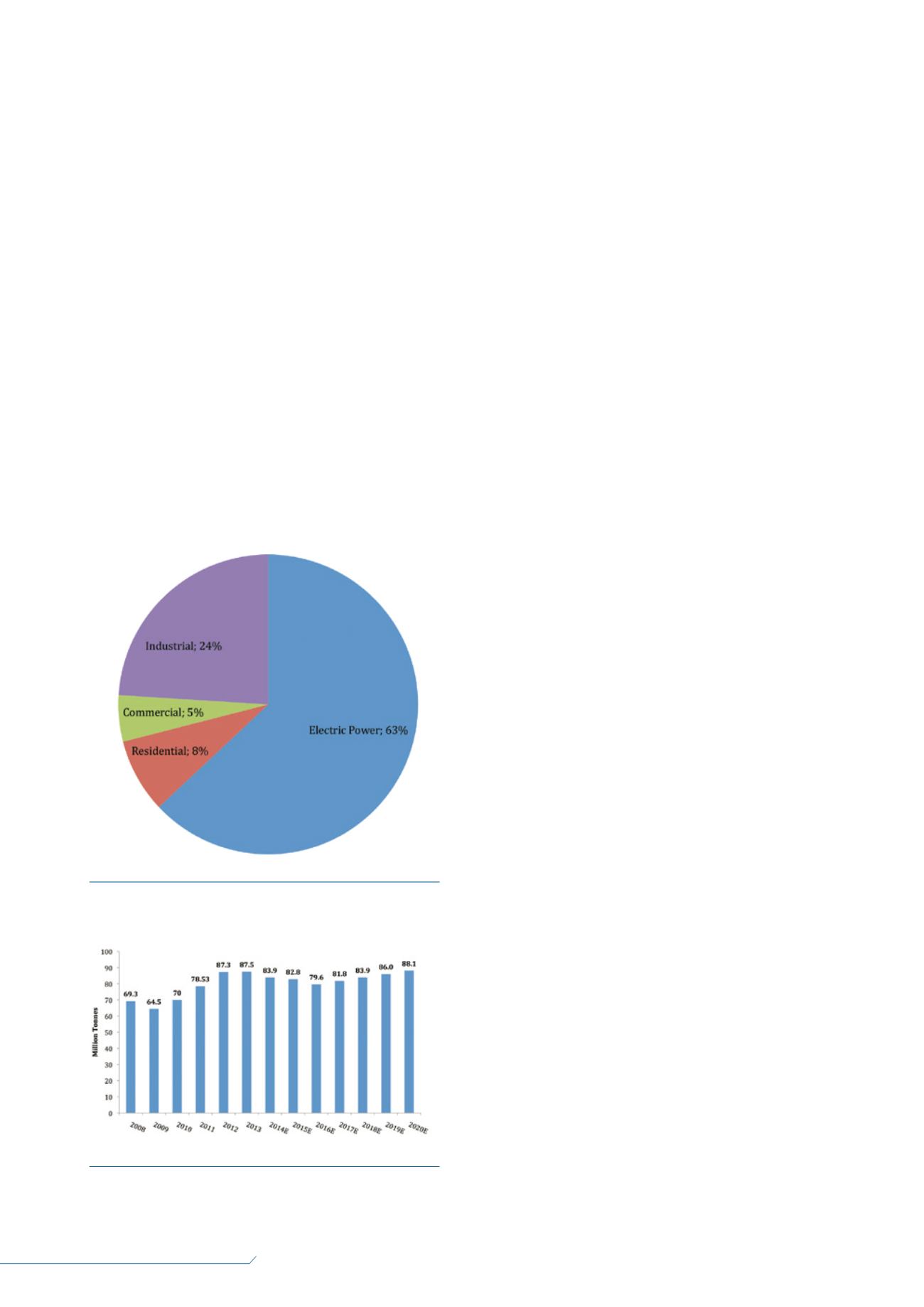

Electric utilities account for 65% of the LNG imported into

the country.

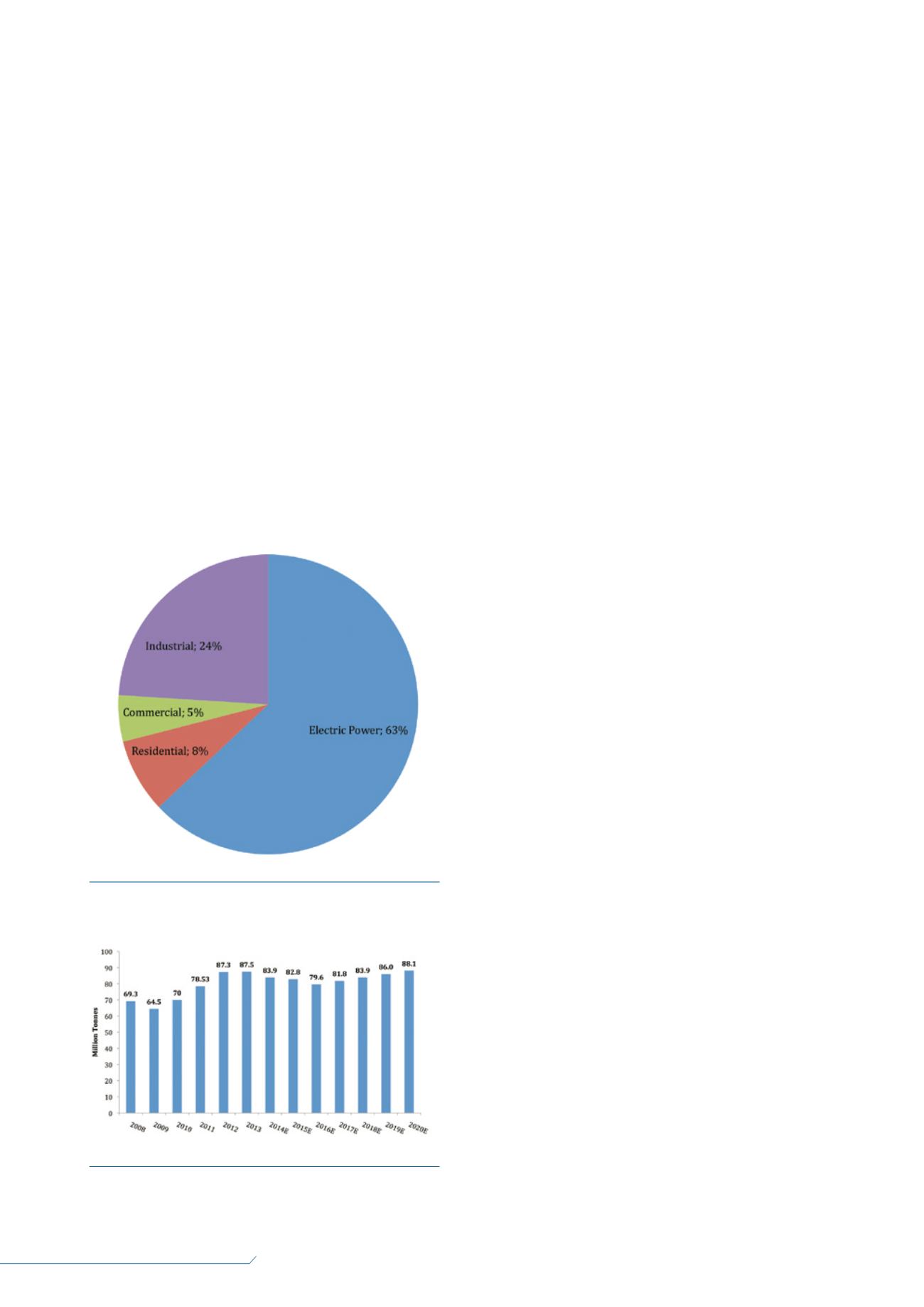

Japan imported 87.5 million t of LNG in 2013 to meet

power generation and city gas needs. With nuclear power

facilities shut down, the power generation segment has been

heavily dependent on natural gas and coal for the past three

years. Around 65% of the total demand for LNG is from the

power generation sector when nuclear facilities are offline.

The share of LNG in the power generation fuel mix jumped

from 29% in 2010 to 41% in 2011 to compensate for the loss

of nuclear power. The city gas supplies cater to industrial,

commercial and residential segments.

Gas demand from the power generation segment will

decrease as nuclear power is expected to make a very slow

comeback in the power generation fuel mix from Q4 2014.

However, plans to increase the installed gas power

generation capacity to approximately 80 GW by 2020 from

the current level of 65 GW is expected to drive up the gas

demand.

Base case scenario for LNG

imports

Frost & Sullivan’s base case scenario forecasts project that

Japan will need to import 88.1 million t of LNG by 2020. The

demand for LNG is expected to show a slight decline up to

2016 before taking an upward trend up to 2020.

The base case scenario projects an increasing demand

trend considering the following assumptions:

Slow growth in electricity demand.

Gradual re-entry of nuclear power into the grid from 2014.

Progressive decommissioning of nuclear power plants

older than 40 years.

Gas power generation installed capacity addition.

Increase in city gas demand.

City gas demand sees increased demand from industrial

and commercial segments but a decline from the

residential segment.

Increasing LNG imports have taken the fuel’s prices to

new highs, creating trade deficits for the world’s third largest

economy. The country’s strategy focus is towards making

LNG imports secure and at the same time cheaper.

The electric utilities and city gas distribution companies

import LNG into Japan, sourcing it from long-term contracts

and spot purchases. Up until 2010, spot purchases were less

than 5% of the total LNG procured. In the last three years,

spot purchases have increased to over 20% of the total

procurement.

Strategies for reducing LNG

purchase price

Since electric utilities are the largest buyers of LNG from

Japan, there is a growing consensus that instead of passing on

increasing fuel costs to electricity consumers, the large LNG

buying companies should work out strategies to reduce the

LNG purchase price.

The LNG prices following the oil prices show a steadily

increasing trend after 2010. Japan pays the highest average

prices for LNG in the world, and these prices have increased,

driven by Japan’s dependence on spot market purchases after

the Fukushima incident in 2011.

In the scenario where nuclear power is not brought online

at all, Frost & Sullivan forecasts the LNG imports to reach a

high of 102 million t. At the current purchase price levels, it

would be unsustainable for the Japanese economy to import

such high volumes, hence the focus is on strategies to reduce

LNG purchase prices.

To meet this objective, various strategies are being

adopted by the Japanese government and the LNG importing

companies to reduce purchase prices.

LNG importers venturing into trading

business

With an increase of LNG suppliers in the global market, LNG

buyers are seeking flexible terms, such as options to resell.

Large LNG buying companies such as Tokyo Gas are

intending to enter into the LNG trading business, reselling

Figure 1.

Japanese gas demand by end user segments, 2013

(Frost & Sullivan estimates).

Figure 2.

LNG imports: Frost & Sullivan’s base case

scenario (Frost & Sullivan forecast. Historical data compiled by

Frost & Sullivan from various industry sources).